Insights from Amelia Oller Westerberg, Energy Advisory Consultant at SWECO, Stockholm

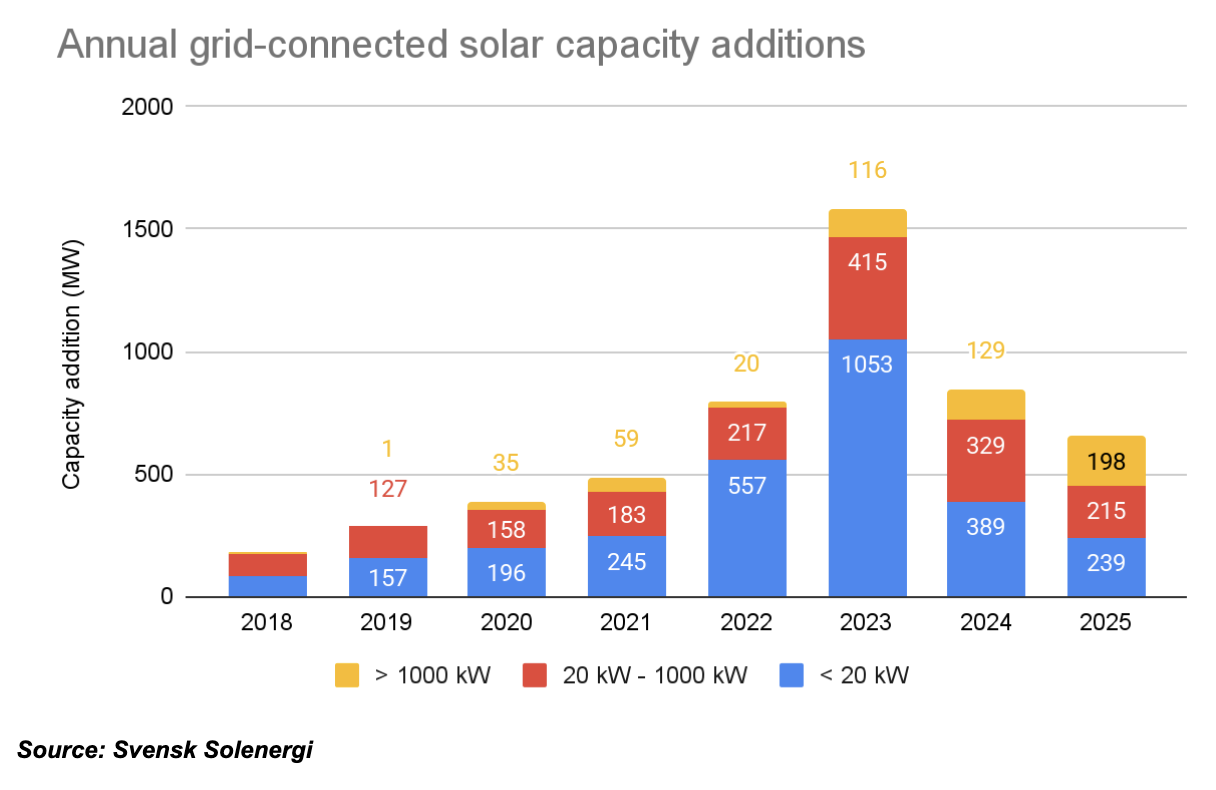

The Swedish solar market has entered a new phase of maturity. After the record-breaking installation year in 2023, when nearly 1.1 GW of new capacity was added, the pace of growth has moderated. In 2024 and 2025, annual additions amounted to 847 MW and 652 MW, respectively, bringing total installed capacity to around 5.4 GW by the end of 2025.

As the rooftop boom has slowed, market momentum has increasingly shifted toward large-scale solar developments, a trend that has been gaining traction since 2023. Looking ahead to 2026, the industry’s focus is moving beyond deployment volumes toward project optimisation, with particular emphasis on utility-scale projects and the integration of energy storage to manage price volatility and diversify revenue streams.

Moving beyond the pipeline: large-scale assets go live

The large-scale systems that were merely planned or under construction 12 months ago are now entering the operational phase. This transition from development to commissioning is reshaping the Swedish generation mix:

- The 100 MW Milestone: The Hultsfred solar farm, developed to supply the H&M Group, was fully inaugurated in September 2025. Now the country’s largest operational park, it serves as a proof of concept for corporate PPAs in the Nordics.

- The Hybrid Precedent: The Skåramåla project has successfully moved from permit to production. By co-locating 39 MW of solar with 50 MW of wind, the facility demonstrates how hybrid assets can provide a more stable, year-round production profile compared to standalone PV.

Why 2026 is the year of the battery

In southern Sweden (SE3 and SE4), grid bottlenecks and price cannibalization have made standalone PV increasingly difficult to bank. Consequently, developers are prioritizing hybridization and retrofitting BESS (Battery Energy Storage Systems) as a necessity rather than an optional add-on.

The shift toward storage is driven by four primary factors:

- Revenue stacking: Beyond arbitrage, co-locating BESS allows developers to tap into the frequency restoration reserves (FCR) and grid stability markets, which have become more lucrative than merchant energy sales alone.

- CAPEX efficiency: By sharing existing grid connection points, developers can significantly lower capital expenditure.

- Profile advantages: Enables new types of PPAs (e.g., base load PPAs) and increases capture prices.

- Market scale: From a modest 80 MW in 2023, Sweden’s storage capacity has scaled rapidly, surpassing 1 GWh of annual additions in 2025.

Looking toward Solarplaza Summit Sweden 2026

As we prepare for the Solarplaza Summit Sweden 2026 PV & Storage in Stockholm, the focus has shifted from simple capacity expansion to asset optimisation. The future of the Swedish market now belongs to those who can manage flexible portfolios and navigate the complexities of a storage-integrated grid.