During a panel discussion at the Solar Asset Management Asia conference, Tetsufumi Miyake (Shinsei Bank), Naoaki Eguchi (Baker Mckenzie), Kiyoshi Doi (Japan Renewable Energy) and Kazuo Wakayama (JAsia) reflected on the landscape of Japan’s secondary solar market and their experiences in the arena of solar asset sales and acquisitions.

How large is the secondary market in Japan?

Kiyoshi, executive officer of Japan Renewable Energy, quoted the report of the Yano Research Institute as stating that the size of the secondary PV market in Japan - in terms of asset movements - amounted to 300-450 MW in 2017. According to the same report, the market will grow towards a size of 800 MW by 2020.

(Source: Yano Research Institute - https://www.yanoresearch.com/press/press.php/001877)

Kiyoshi said that the current size of the secondary market is relatively small, especially considering the fact that Japan boasts around 40 GW of installed solar capacity. Japan counts about 900,000 ‘industrial scale’ PV plants (> 10 kW systems). Among them, nearly 10,000 plants are classified as ‘mega solar’ (large- or utility-scale PV) plants. Thus, 300MW constitutes less than 1 % of the total capacity base. Such a lack of transactions would point to a very static market landscape.

David Litt from KEIO University, however, said that this seemingly small number could also be a result of the lack of transparency and shortage of accurate information. The actual size of the secondary market would most likely be significantly greater, but with current conditions it is nearly impossible to establish the right number.

What exactly do we mean by ‘secondary PV market’?

“The term ‘secondary PV market’ relates to the sales and purchases of operational solar PV assets. In the actual transactions, this is also mixed with the selling and purchasing of land rights that are involved in these PV plants,” explained Naoaki Eguchi of Baker McKenzie. Tetsufumi Miyake of Shinsei Bank echoed his remarks and mentioned that Shinsei Bank was working on the project finance for two operational projects (both 20 MW in size) last year, giving him first hand experiences with the market landscape.

Who are the key players?

Companies that are active in the secondary market traditionally include independent power producers (IPPs), financial institutions, institutional investors, individual investors, infrastructure funds and other types of asset management firms. Fueled by the expansion of the market, the demand for evaluating the brokerage of transactions and more detailed technical and asset value evaluation has increased the involvement of EPC and O&M companies in this market. Prolific companies active in the market include Pattern Energy, Pacifico Energy, Canadian Solar, GSSG Solar, Sparx, Renewable Japan Energy Infrastructure Fund, SB Energy, Mitsubishi, Ichigo, Daiwa, Japan Asia Investment and Sonnedix, amongst many others.

Eguchi said that firms like Baker McKenzie offer services on both the seller and the buyer side. He’s noticed an increased activity from Japanese firms on the selling side, including electricity and gas companies, and increased interest from foreign companies in acquiring Japanese assets. An interesting recent example was the acquisition of a 206 MW renewables portfolio (including 39 MW of solar) by Pattern Energy, a US-based asset manager. Another example of a major foreign player is Canadian Solar, which is both actively developing its own plants in Japan, as well as acquiring others, to grow its Japanese solar portfolio.

How to get reliable information about the secondary market?

Although the secondary market in Japan is beginning to move, the persistent lack of transparency continues to hinder the maturation. You can find limited information about solar plants on METI’s website (Ministry of Economy, Trade & Industry), including the sizes of projects. However, information regarding ownership and transactions is often missing, especially when they don’t involve listed companies.

To provide some concrete examples and illustrate the landscape, we've listed a few recent transactions on the Japanese secondary solar market. This list, however, is evidently incomplete both in terms of sheer scope and data provided.

Examples of transactions on Japanese Secondary Solar Market

Seller

Buyer

Assets (MW)

Transaction Value (JPY)

Details

Date

Canadian Solar Canadian Solar Infrastructure Fund 30.40 11.5 billion 273 MW Daisen-cho, 2.1 MW Ena-shi and 1 MW Takayama-shi plants 2018 Sep

n.d.* Pacifico Energy 36.20 n.d.* 12.3 MW Yanai and 23.9 MW Yuza plants 2018 Jul

Tokyo Century Tokyo Gas 10.00 n.d.* 2 projects in Kyusyu 2018 May

Green Power Investments (GPI) Patern Energy 39.00 n.d.* 29 MW Futtsu and 10 MW Kanagi plants 2018 Feb

n.d.* Canadian Solar Infrastructure Fund 2.60 920 million 636 kW Koriyama-shi and 1.963 MW Tsuyama-shi plants 2018 Jan

Renewable Japan Renewable Japan Energy Infrastructure Fund n.d.* 5.83 billion 8 projects 2018 Jan

Ichigo Ichigo Green Infrastructure Fund Investment Corp (yieldco) 3.60 1.47 billion 2 small projects 2017 Sep

General Energy Solutions Inc.(Taiwan) ASGJ PROJECT2 14.70 n.d.* Fukushima Solar park 2017 Jul

Neo Solar Power (General Energy Solutions - GES) Canadian clean energy company (n.d.*) 14.68 n.d.* 14.68 MW Fukushima solar plant 2017 Jul

Marubeni SB Energy & MUL Energy Investment 29.80 n.d.* 29.8 MW Tomakomai Yufutsu Mega Solar project 2017 Mar

Marubeni Japan Asia Investment 82.00 40 billion Oita project 2017 Feb

Conergy Japan K.K. n.d.* 3.75 n.d.* 3.75 MW Sannohe solar plant 2017 Feb

HASEKO Corporation Japan Benex 3.20 n.d.* 2 projects in Chiba 2016 Nov

Ichigo Ichigo Green Infrastructure Fund Investment Corp (yieldco) 25.80 10.3 billion 13 solar plants 2016 Oct

What are the challenges in the secondary market?

During the discussion, Eguchi and Miyake explained the main challenges that they face in the Japanese secondary PV market, referring to actual cases they encountered. These challenges include:

- Full transaction information is not made public;

- The difference between the seller and the buyer’s price evaluation is often very large;

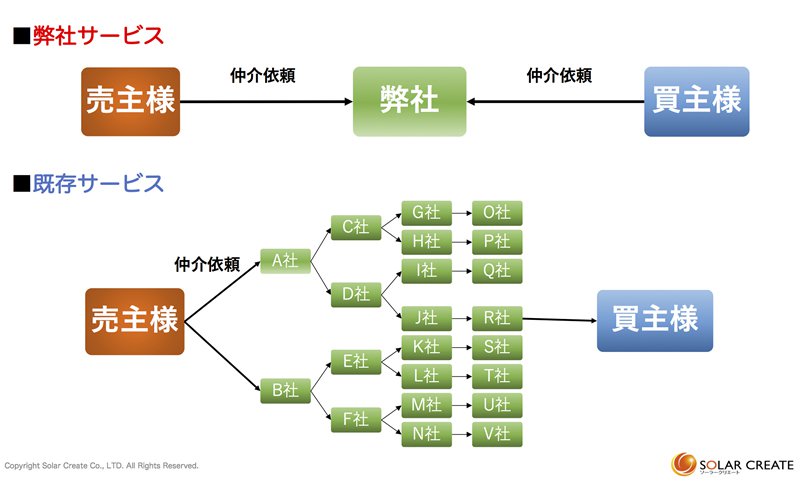

- Many brokers and ‘middle-men’ meddle between seller and buyer, causing many transactions to stall or fail completely;

- The intentions of sellers and buyers are not clearly reflected or stated in the transaction;

- Extensive due diligence is required by investors in order to purchase operational assets.

(chart that illustrates how Japanese transactions can include several brokers and extra complications, causing the due diligence and transaction costs to steeply rise. Source: Solar Create - http://www.solar-create.com/scheme.html)

Activities of organizations to secondary market

On of the reasons for the discrepancy in expectations between sellers and buyers is that Japan has no standard system in place for the evaluation of solar assets. Kazuo Wakayama, director of JAsia, mentioned that the concept of machine equipment evaluation is not established in Japan. People in the market do not know how to properly evaluate PV assets and there are no guidelines to support that (yet).

As mentioned before, there are about 900,000 industrial PV facilities (> 10 kW) in Japan currently, including 10,000 ‘mega solar’ location. For those larger projects - involving large project financing as well - relatively few issues arise if compared to the smaller projects, which are often troubled by construction problems and primitive issues. JaSIA mentioned they are currently involved in a collaborative effort with JAREA (Japan Association of Independent Appraisers) to develop a valuation methodology of solar facilities, following the professional ‘plant, machinery and equipment’ (PME) valuation methodology and format. Evermore and JPEA (Japan Photovoltaic Energy Association) also recently published the "Evaluation Guide for Solar Power Generation Projects" and expect that this guideline will be used as a standard manual for future evaluations.

Further reading: https://tech.nikkeibp.co.jp/dm/atclen/news_en/15mk/071202224/?ST=msbe

Further reading: http://solar.co2o.com/ja/activity_ja/report_20180702/

The secondary market for small- and medium-sized projects

This segment is characterized by the activity of specialized project brokers. Examples of brokers of secondary PV plants include:

- Tainabi Hatsudensho (Link) / Goodfellows

- SOL SELL (Link)

- Mega hatsu (Link)

- Taiyoukoukaitori.com (Link) / ComPower Inc.

- Kurabe-ru (Link)

All of these brokers sell PV plants together with land rights, advertising the promise of obtaining a yield of 10% or more through their ‘one stop service’. Their offerings are often not completely clear or publically available through websites, etc.

As all these companies are trying to differentiate themselves, the Tanabi Hatsudensho company, operated by Goodfellows, is introducing an interesting system called ‘web risk diagnostic evaluation’. In this construction, the power producer (plant seller) is asked to indicate the hidden risks associated with their asset in on a 4-grade scale. The diagnostic logic stems from the ‘business plan formulation guidelines (solar power generation)’, as published by the Agency for Natural Resources and Energy (part of METI). As the number of responses is judged to be high in violating items and risk increases, the result of risk diagnosis evaluation will be low.

Further reading: https://www.kankyo-business.jp/column/020680.php?page=2

Further reading: http://www.itmedia.co.jp/smartjapan/articles/1807/02/news019.htm

Conclusion

Japan’s secondary market is on the rise, with growing awareness related to O&M and asset management contributing to the market’s maturity. Assets are increasingly moving, but alongside that dynamic, some problems are emerging as well. Many of those are related to a lack of reliable information and the absence of standardized asset valuation methods. Japan’s geography and vulnerability to natural disasters mean that projects have higher risks and require more detailed due diligence and evaluation, especially upon transaction. In order to smoothen the transaction process, sellers need to be required to disclose all the data and contracts related to the construction and operation of the project. A hopeful sign of market maturation, is the fact that initiatives are underway to create supporting guidelines, eliminate poorly-engineered projects and create a transparent marketplace for the buying and selling of healthy solar assets.