For the third year in a row Solarplaza is glad to share with you the latest edition of our ‘’Top 70 PV portfolios in Europe’’ overview. In recent years, falling government support, increasing competition and harsh financial outlooks have continuously been spurring market consolidation, with fewer owners holding portfolios of increasing sizes. And so the secondary market in Europe has become even more active with a record level of mergers and acquisition.

Similar to last year, most of the portfolios in the Top 10 are based in Germany and the UK. This year, however, the UK takes the lead with a total of 2.4GW worth of portfolios represented in the Top 10. Germany accounts for a stable 2.2GW, while France brings in 445MW and Italy 334MW. This is speaking in terms of countries, of course.

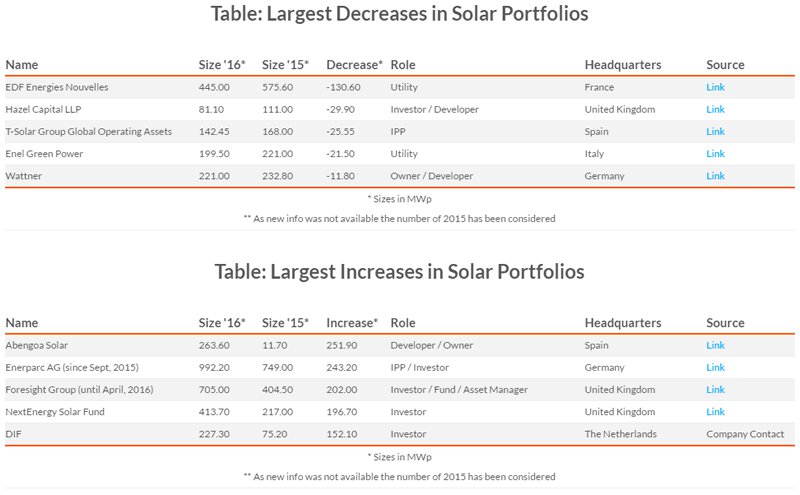

Looking at individual portfolios, it’s Lightsource Renewables (again from UK soil) that leads the pack with their 1,042MW portfolio. Lightsource is joined on the podium by runners-up Enerparc (992MW - Germany) and Foresight Group (705MW - UK). EDF (445MW) is the first French portfolio-holder in the list and RTR Energy (334MW) is the first entry from Italy.

On average, the companies owning the top 10 of largest PV portfolios have managed to annually grow their portfolio by 72.7MW. Looking at the full top 70 overview, the average annual increase of the portfolio has been approximately 23 MW.

“The majority of owners are investors”

Analyzing the different companies owning the 70 portfolios in this overview, we noted that 38% of these firms classify themselves as investors. IPPs own 24% and developers (that also own their own plants) account for 22% of the overview. Only 8 portfolios are owned by utilities, which corresponds to 10% of the total.

The tables below show the 5 portfolios that grew their portfolio most in the last year and the 5 portfolios that dropped most MWs from their portfolio. From the table we can see that EDF Energies Nouvelles had the biggest decrease in portfolio with 130.6 MW of capacity ‘lost’ and Abengoa Solar experienced the biggest increase, expanding their portfolio by 251.9 MW in a year.

This report has been made in preparation for the fourth edition of the Solar Asset Management Europe conference, which will take place 9-10 November 2016 in Milan, Italy. During the event, experts from all over Europe will address topics like: the secondary market in Europe; portfolio management, asset valuation; and many others.

Get access to the full Top 70 overview

Leave your contact and get immediate access to the full top 70 overview of the largest European solar PV portfolios.

The "Top 70 overview of European solar PV portfolios" is provided by Solarplaza International BV ("Solarplaza") as a service to its customers on an "as-is, as-available" basis for informational purposes only. Solarplaza assumes no responsibility for any errors or omissions in these materials. Solarplaza makes no commitment to update the information contained herein. The data used for this overview are as of July 15, 2016.

The "Top 70 overview of European solar PV portfolios" is protected by copyright laws, and may be reproduced, republished, distributed, transmitted, displayed, broadcast or otherwise exploited in any manner only by accrediting Solarplaza as the source and providing the full hyperlink to: www.solarassetmanagementeu.com

For questions please contact Shushan Khachatryan, [email protected]