Latin America has long been considered one of the main focus regions in the area of renewable energy and recent market developments are only solidifying its position. Although Chile is known as the single most prominent market on the continent, recent trends are seeing Mexico, Brazil and Argentina closing the gap.

The increase in renewable energy capacity, however, can have impactful consequences in terms of available grid capacity, which may eventually lead to energy curtailments and spot market price decoupling. Since both of these aspects can have severe financial consequences for investors, Solarplaza set out to examine the issues at hand and map out the current trends in order to find solutions to mitigate the risk associated with it.

This article, based on a recent Solarplaza webinar ('Opportunities in the Chilean solar market & comparison with other LATAM markets' - full recordings & slides available now), comes in preparation of the Solar Asset Management LATAM conference and networking platform, which is set to take place on the 17-18 of October in Santiago de Chile. A track record of 12 previous Solar Asset Management conferences globally and 11 events in the Latin American region guarantee the top-tier quality of information on solar PV portfolios and all asset management and O&M related topics. For more information regarding the event, please visit our event website.

LATAM at a glance

The fact that Latin America is one of the most interesting solar market regions for investors is no coincidence. The remarkable irradiation levels prime the region for solar success. Consequently, the share of LATAM solar will be taking up an increasingly larger chunk of the global PV demand, which is set to increase from 1.6% in 2016 to 11.5% in 2022.

Similar to the size of the global solar market, the drivers for global demand are also changing, Manan Parikh - LATAM solar market analyst at GTM research - points out. The initial, subsidy-dependent phase of solar power development, where projects were rushed to be completed, is slowly taken over by a new, more sustainable era in which the costs of establishing solar plants are directly competitive with that of other renewable and conventional energy sources. The main forms of initiating solar development in the new era are tender or auction schemes, which most countries in LATAM either already have in place or are in the process of planning. The main advantage of this process is that governments can plan additional solar projects in ways that properly consider infrastructure constraints.

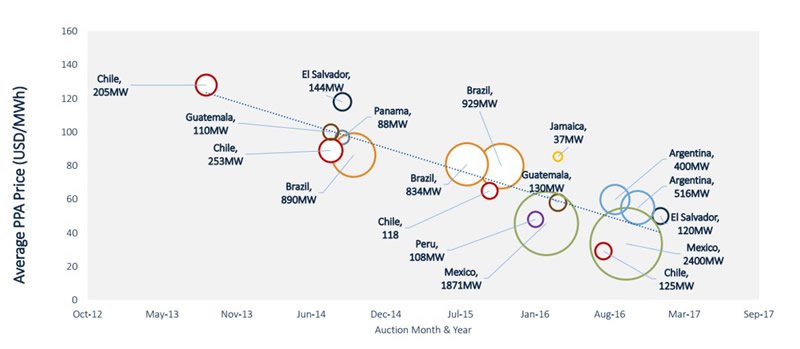

Figure 1: The average PPA prices in LATAM over the 2012-2017 period (SOURCE: GTM RESEARCH)

Another notable trend that shapes the investor climate in the region is the declining PPA prices that have been noticeable over the past years. Since the beginning of 2013, average PPA prices have dropped from a $120/MWh to the current level of less than $30/MWh (Figure 1). The financial viability of solar projects, in light of the decreasing trend in average PPA prices, are due to the subsequent decline in system pricing. Total system prices, which in 2016 were observed at $1.24, are projected to decline to 0.92$ by 2022 (which relates to the whole system, and not EPC activities alone)

Individual country assessment

When zooming in on the Chilean and Brazilian solar markets the differences are significant, but this might not be the case for long. Chile has added a capacity of 827 MWdc in 2016 whereas the respective installation number in Brazil only amounts to 28 MWdc. The sheer size of Brazil, however, will prompt a sharp increase in solar translating into cumulative growth forecast of 7.1 GW whereas Chile will fall behind adding 5.8 GW during 2017-2022. These values, however, are complicated by the economic slump the two countries are currently experiencing. Consequently, 2.6 GW and 900 MW of solar capacity may fail to come online in Brazil and Chile respectively.

Not all focus should lie on these two major players, as there are more high-potential markets in the region that deserve attention. Mexico and Argentina, for example, are also expected to experience a solar surge. Mexico’s growth will be driven by its ambitious energy targets and huge emphasis on solar power as the main non conventional renewable energy source, whereas Argentina can rely on a recently established, but thoroughly enabling framework to spur growth in the sector.

Looking further, Colombia and Peru were also prominently named as solar markets with increasing potential, according to Mr. Parikh. Both of these markets currently contribute negligibly to the South American solar PV demand, but should grow over tenfold by 2022, reaching 440 MW and 300 MW of solar capacity in Colombia and Peru respectively.

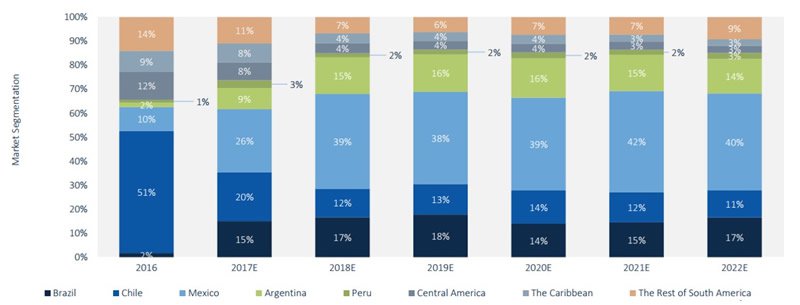

Due to its dynamic nature, the regional sector will go through considerable changes over the years to come. The annual PV demand-share landscape of the current participants will go through a moderate transformation to give way to emerging solar markets (Figure 2). In addition to the changing landscape, the share of non-utility-scale solar power will also increase, as commercial, residential and industrial applications become more attractive.

Figure 2: The share of Annual Regional PV Demand of LATAM markets (2016-2022E) (SOURCE: GTM RESEARCH)

Chilean spot market development

Renewable energy sources in LATAM, besides the unquestionable benefits, may sometimes pose challenges, due to their variable nature. These issues are especially apparent in Chile, where the unique grid infrastructure and the ever-increasing share of renewables in the country’s energy mix made it difficult for project developers to adopt the merchant model as main method of project finance.

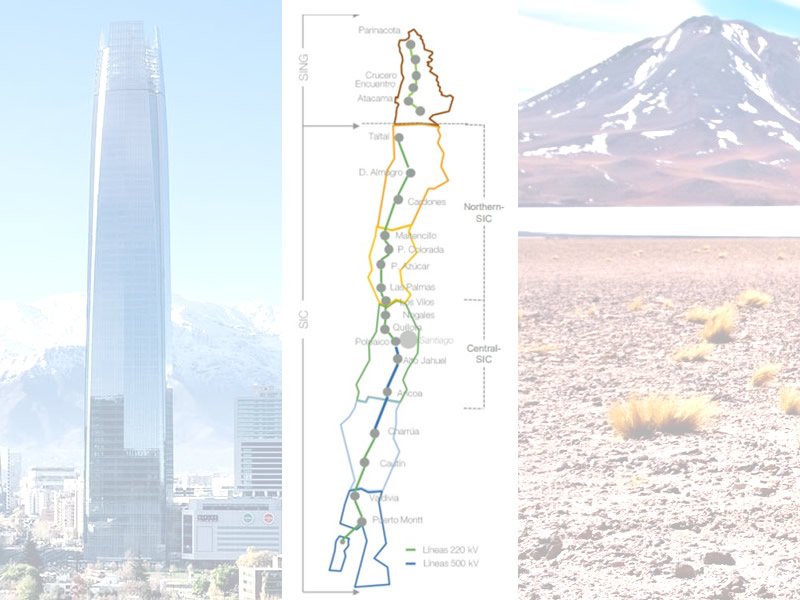

To understand the cause of the problem, it’s paramount to be familiar with Chile’s grid situation, a story mainly dominated by the nation's central grid structure (SIC). The SIC comprises of a northern-SIC and a central-SIC of which the former has had to deal with a tremendous increase of renewable energy supply. “This change in the conventional to non conventional energy ratio has forced market participants to adapt to the new environment and adopt more stable financial models” - points out Mr. Ignacio Mena, the associate and head of market modelling at Antuko Energy SA.

Figure 3: An overview of the Chilean energy distribution system.

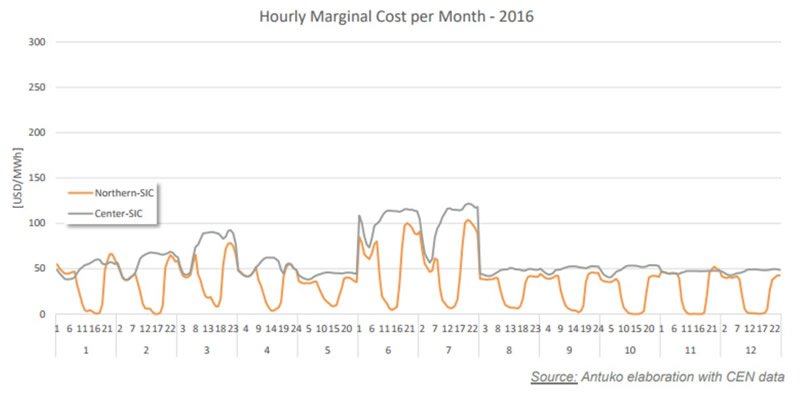

In 2009, when the northern-SIC’s renewable capacity was negligible and the majority of energy was supplied by coal and gas plants; energy prices on the spot market were coupled across the two grid segments (Figure 3). During this time 78 MW of wind energy was in place and no solar energy. Fast forward to 2016, where solar capacity has surged to 922 MW and wind power to 709 MW. This variable energy capacity increase caused significant price decoupling on the spot market with solar hours amplifying the phenomenon (Figure 4).

The implications of this not only emerged in the spot market prices - which reached 0 USD/MWh - during the peak solar hours, but also resulted in significant wind and solar energy curtailment and the cycling of conventional power plants in an attempt to manage load volatility.

Figure 4: Hourly marginal cost per month (in USD/MWh) for Chile in 2009. (SOURCE: ANTUKO)

Figure 5: Hourly marginal cost per month (in USD/MWh) for Chile in 2016.(SOURCE: ANTUKO)

In an attempt to address the issue, several transmission reinforcement measures will be implemented in the years to come. In the meantime, however, banks have ceased to provide funding for projects relying on spot market prices as source of income, due to the increased risk associated with such undertakings. This shift in the financial environment forced project developers to look for an alternative financial model that did not rely so strongly on the unfavourable spot market conditions.

Power generators in Chile have the option to sell energy at a stabilized, constant price which is an alternative nodal price determination that is determined every 6 months by the National Energy Commission. Such a price is available for small generators (<9 MW) that are either connected to the distribution system (PMGD) or to any other transmission segment (PMG, <20 MW). Although this option has been present before, high spot market prices made for a better financial case.

In light of the new energy landscape and the continuous trend for renewable energy inclusion, the stabilized price commercial model has peaked many interests. The new model has experienced a growth rate of 5.7 MW/month since August 2016. Besides its suitability to obtain financing, the PMGD commercial model also allows self-dispatch and 4-year-long engagement terms that can be renewed. Some issues associated with the use of the model are the necessity to develop portfolios as projects are rather small; and increased competition for those wanting to pursue this option due to the limited connection capacity. To really thrive with this model, a developer will need to aggregate multiple of these smaller plants into a portfolio, as banks are more eager to finance bigger projects and due to achievable economies of scale in terms of O&M and asset management activities

Overall, the LATAM market is constantly displaying vigorous renewable energy activity, which has so strongly characterized the region in its recent past. With the promising trends surrounding countries are showing, Chile will certainly not remain to be a lonely renewable powerhouse in the future. As a pioneer, however, Chile’s market development can provide important learning points for the developing renewable energy market of the region as a whole. The diversification of commercial models might prove to become inevitable for other markets as well, as renewable energy gains larger penetration and causes disruption in energy management.