A scramble to get plants finished before the current US investment tax credit (ITC) runs out could end up harming project bankability, Solarplaza has learned.

The rush to complete projects is putting a strain on component supplies and leading developers to buy potentially lower-quality products, said Dr Ralph Romero, management consulting director and Black & Veatch.

“There is a significant effort in getting projects, especially large-scale projects, into the ground before the end of 2016,” he said.

“The reason for that is that currently there’s an investment tax credit that is set to decrease from 30% to 10% for utility-scale projects by the end of next year.”

That has created a shortage of modules from top-tier manufacturers, and a search for alternatives. “What we’re seeing is a lot of activity amongst manufacturers that previously were not very well known in the United States, if at all,” Romero said.

The situation is exacerbated by anti-dumping laws that make it difficult for US developers to source components directly from China and Taiwan. This means some top-tier module makers are sourcing white-label products from untested sources.

“We’re seeing modules appearing in the US market from places that are not very well known,” Romero said.

Black & Veatch is regularly hired to carry out supplier bankability assessments and has amassed more than 100 reports on the quality and reliability of modules and other solar components.

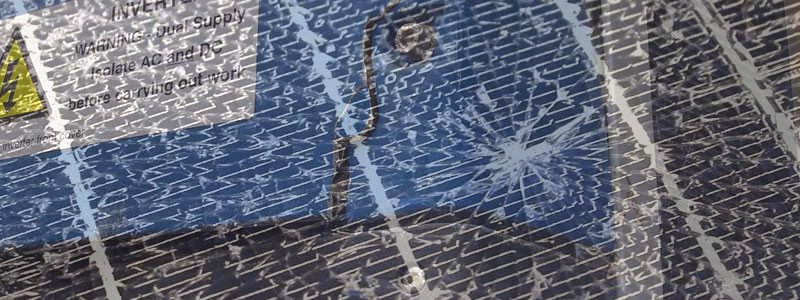

“What we are finding is that there is a lot of variability in terms of quality from one manufacturer to another,” said Romero. “This is of significant concern to us and our clients.”

As a result, he said: “The concept of bankability is as important as ever, because what we are seeing is products that do not appear to have the same quality as the products we used to see.”

This is certainly true where bankability is seen as providing assurance to the lender.

Graham Smith, founder of the loan financing business Open Energy Group, said: “The performance of solar projects over time validates the expected performance of new projects and thereby provides comfort for long-term debt providers.”

But Abakus Solar USA chief executive James Huff believes investors may be looking at bankability in the wrong way. “Every project is ‘a company’ that sells power to a utility or whatever,” he said.

“So the bankability of solar is the insurability and financial health of an individual project.”

This may include factors such as the financial strength of the off-taker, a consideration that does not usually seem to be taken into account by lenders. Smith of Open Energy Group nevertheless agreed that off-taker stability was important.

“The four main elements of bankability are a reliable long-term cash flow, quality components, experienced construction and a dependable operator to ensure long-term performance,” he said.

“All elements are intertwined, because without strong performance you cannot generated the expected revenue, and performance is directly linked to the construction, components and long-term operation.”

Learn more about the ins and outs of solar bankability at Making Solar Bankable: Emerging Markets, on February 18 and 19 in Amsterdam, the Netherlands. Register before December 17 for a €100 early-bird discount.